THREDUP (TDUP): INVESTING IN SECONDHAND FIRST

Why ThredUP could be the long-term winner in fashion resale

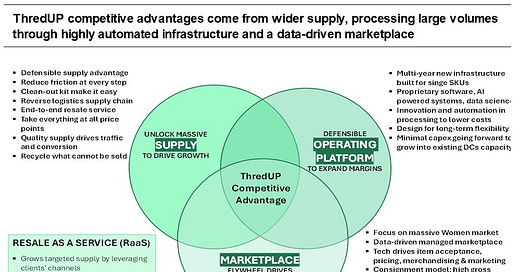

This analysis identifies ThredUP as the likely long-term winner in the fast-growing emerging apparel & fashion secondhand online market in the US. The company has a very differentiated business model and operating capabilities, which we expect to yield a leading market share and superior free cash flow generation and margins:

1. It operates a complex “managed marketplace”, for secondhand fashion which required substantial upfront investments in processing, distribution centers and technology. We expect its “asset heavy” operating model to create and reinforce significant barriers to entry and competitive advantages over the medium term.

2. It offers all price points and brands, from fast fashion to luxury, making it a “one-stop-shop” for both buyers and sellers. This approach widens its TAM, providing a superior solution for consumers who ultimately seek above all fast processing, convenience (sellers), assortment and price (buyers).

3. ThredUP long-tail platform is built upon a data-rich and tech-led model, which we expect will benefit disproportionately from advancements in processing, Artificial Intelligence and robotics to drive better consumer experience and operational efficiencies.

2025 will mark a critical turn for the company, starting in our view a multi-year period of positive free cash flow generation and rapidly improving returns. The company will: (i) fully focus on its now profitable US business, after exiting Europe (Remix); (ii) capitalize on a suite of AI innovation introduced in 2024 to drive improved consumer experience and greater operating efficiencies; (iii) reaccelerate user growth, from higher investments in customer acquisition, improved merchandising sculpting and wider adoption of secondhand

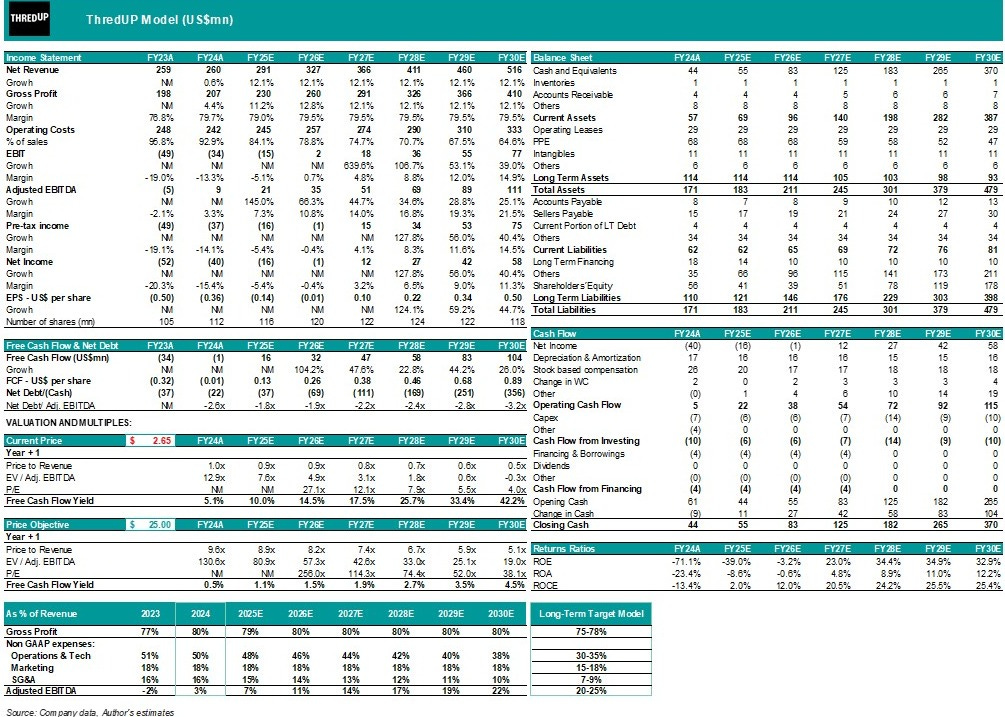

The share price decline since the 2021 IPO (-77%), underappreciates the company’s potential to become a strong compounder, with an identifiable and expanding moat and secular growth prospects. For the next 5 years this analysis conservatively projects CAGR of 12% in sales, 58% in Adj. EBITDA and a 2030 EPS of $0.50, yielding a potential Share Price of US$25.0.

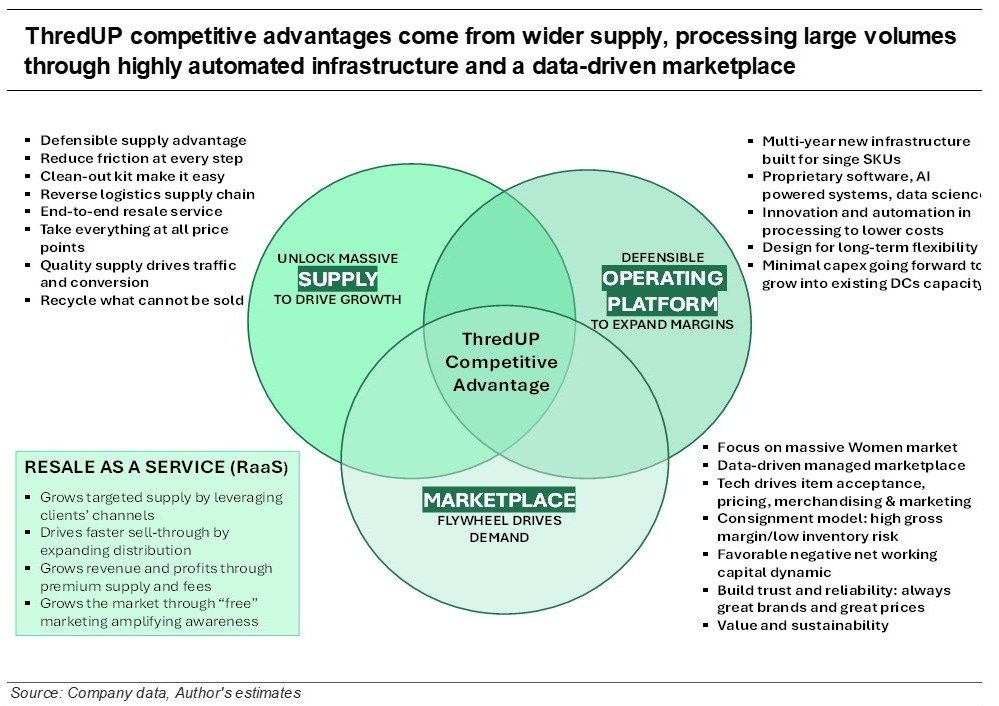

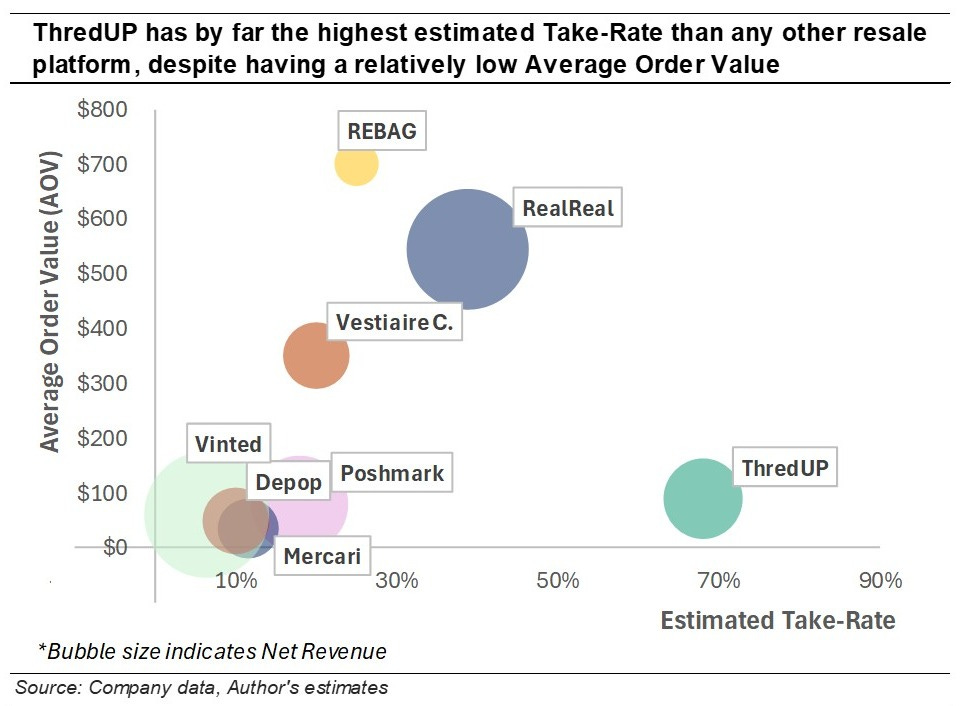

We have also benchmarked ThredUP with other fashion e-commerce peers both in secondhand and full price. This analysis points to already superior unit economics, despite the company’s smaller revenue scale and greater complexity of running a price-agnostic managed platform as opposed to peer-to-peer asset light models (Poshmark, Depop, Vinted) or luxury-only platforms (The RealReal, Rebag).

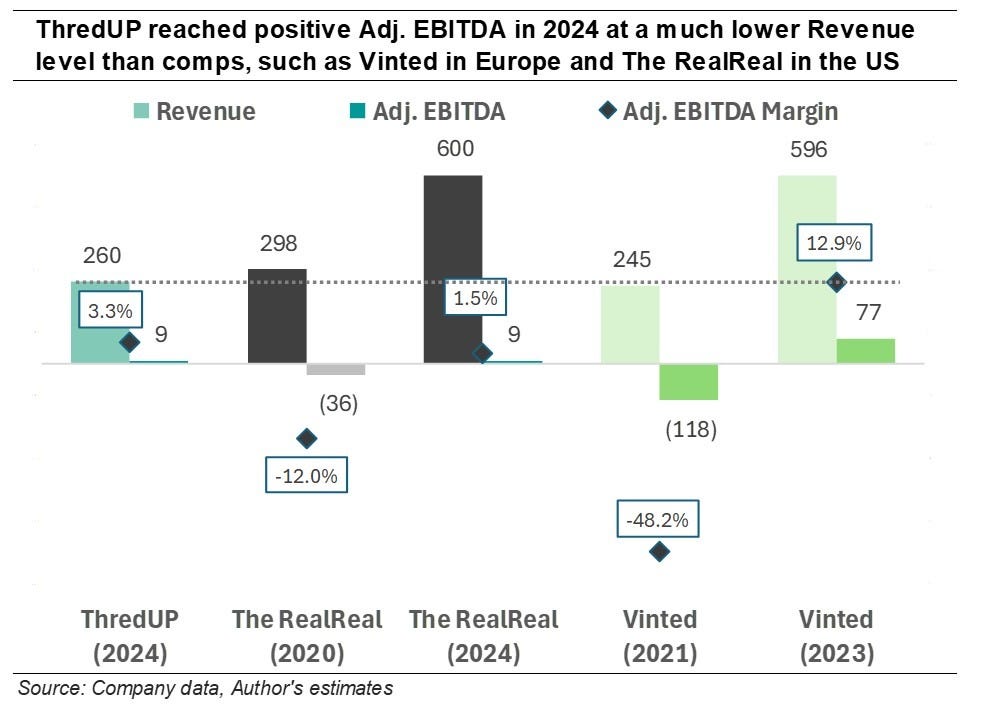

ThredUP Adjusted EBITDA Margin of 3% in 2024 was achieved with lower revenue, of US$260mn. By comparison, in Europe, peer-to-peer platform Vinted reached positive EBITDA only when crossing the US$500mn mark, while The RealReal reached Adj. EBITDA breakeven with double the size of ThredUP sales.

The company has a leading Gross Margin of 80%, already above its long-term target of 75-78% set at the IPO, despite the still low Revenue per Active Client (RPAC) of c.200$. This compares to >400$ for The RealReal, Stitch Fix and Revolve.

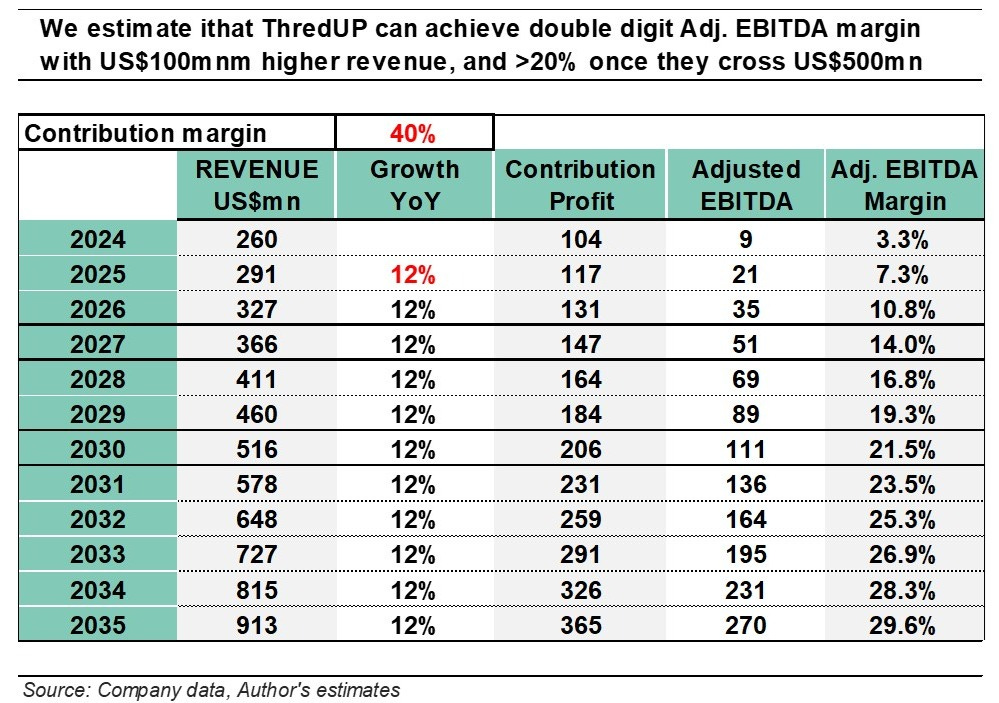

The Contribution Margin is now 40%, >10p.p. higher than the 2021 level. Consequently, we estimated that ThredUP should reach mid-teens Adj. EBITDA margin with an incremental US$100mn in revenue and >20% once revenue crosses the US$500mn mark.

Our analysis shows that ThredUP has multiple levers to ultimately achieve revenue of US$1bn+ within the next 10 years, at which level we project Adj. EBITDA of >25% and mid-teens net margin, before material new investments in expansionary capex.

We also see additional potential sources of accretive revenue upside:

Solidify its RaaS (Resale-as-a-Service) business through deeper partnerships with brands, leveraging its reverse SKUs logistic capabilities, and competing at the margin with the off-price channel.

In-roads into Direct Selling and Social Commerce, capitalizing on its large number of users and library of items, introducing some form of high margin advertising fees for brands and sellers.

US M&A as resale continues to mature and consolidate.

Failing to sustain Buyers/Sellers growth is the key risk in our thesis.

ThredUP has leaned into complexity upfront, to establish a durable competitive moat

The company was founded in 2009 by James Reinhart and Chris Homer (current CEO/COO) to fix a “market failure” for lower price secondhand clothing in the US which, beside the traditional IRL goodwill channel, had no available solution for monetization online. The intuition went through several iterations (peer-to-peer initially, men’s only, then kids’ clothing) before assuming its current form of a managed secondhand marketplace to sell and buy women’s and kids fashion online across all brands and price points.

Under its mission to inspire a new generation of consumers to “think secondhand first”, the company has scaled to its current size of US$260mn in revenue and 1.3mn active users in the US, through a business model that leans on complexity and differentiation and contrasts starkly with other “asset light” platforms in resale, such as Poshmark, Depop or Vinted (and eBay), as well as with those that prioritize only certain brands and price points, such as luxury resellers The RealReal and Rebag. The most important innovations and differentiations that ThredUP is built upon are:

Sellers can ship any item and brand (for women and kids) through a convenient “Clean Out Kit” using a pre-paid label and as long as they follow certain standards for quality and conditions. This removes friction and allows users to leverage ThredUP for their entire closet, increasing supply.

ThredUP receives, categorizes, photographs and stores all the items on behalf of the consignors, doing the heavy and time-consuming work for them. This required high capex investments in DCs and technology which are unparalleled compared to any other platform in this space.

Buyers are targeted with a wide “long tail” assortment of more than 4mn items, using data, algorithmic pricing, machine learning capabilities to maximize demand and turns. All items are presented consistently aiming at making “buying secondhand indistinguishable from buying new”.

ThredUP makes money from sellers through a (i) processing fee, introduced in 2022 and now set at $14.99 for standard and $34.99 for premium processing (higher acceptance, faster turnaround and longer selling window); (ii) a cut of the selling price for each item sold. The company states that, on average, sellers make net of fees 10-60$ for standard kits and 50-150$ for premium kits. ThredUP typically accepts 50-70% of the items received and consignors can opt, for a fee, to receive back the items that are not accepted/sold or they become ThredUP’s property and can remain for sale after the end of the selling window period or diverted to donations or other channels (third-party platforms, recycling, rescue boxes etc.). Buyers pay for shipping ($8.99, free for orders >$89) and returns ($3.99/item).

ThredUP Take Rate is c.70%, substantially higher than any other resale platform.

The company also benefits from a negative working capital dynamic as buyers pay upfront at purchase, but consignors receive the pay-out, net of the above fees, at the end of a 14-day return window for buyers, and they on average take more than 60 days to cash in the funds or use them as credit for other purchases. This operating model is in equilibrium when it matches two complementary needs and incentives:

For sellers it maximizes convenience. ThredUP does everything on their behalf and they don’t have to worry about what they can/cannot ship to the company. By contrast the payout, per item, tends to be lower than peer-to-peer platforms on which they can retain more, but can be very time-consuming and inconsistent to operate on (taking pictures, adding descriptions, dealing with buyers, set discounts and promotions etc.)

For buyers it maximizes assortment and value. They can find on the platform the largest variety of brands and depth of assortment, all presented visually in a consistent and comprehensive format with accurate details on material, measurements etc. Moreover, items are progressively discounted as the selling window advances, to increase turns, so prices tend to move lower compared to other resale platforms.

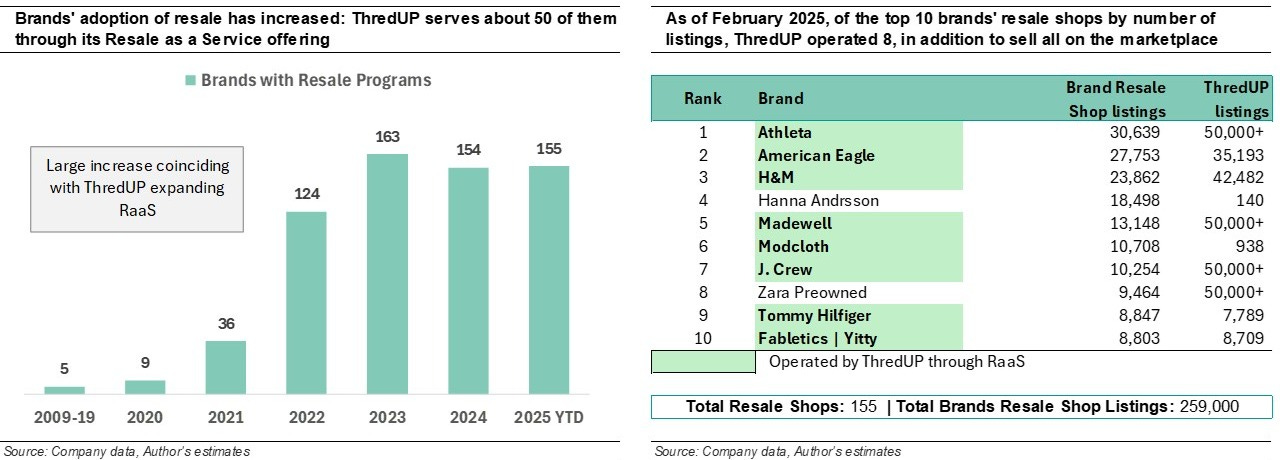

Resale-as-a-Service (RaaS): ThredUP also partners with retailers/brands (currently >50) with its RaaS service, through which they can offer a branded clean out service and/or a turn-key resale shop using ThredUP inventory. For ThredUP RaaS generates fees, quality supply, demand and awareness.

ThredUP share price performance since its 2021 IPO has been extremely punishing

The company IPO took place in March 2021, with 14mn share sold at $14.00, raising net proceeds of $175.5mn. In August 2021 there was a follow-on for 2mn shares priced at $24.25, for further net proceeds of $45.5mn, or a total of $221mn. Prior to going public the company raised more than $300mn. At the IPO, shares were priced at 7.0x 2020 sales for a market cap. of 1.3bn and at 12.5x 2020 sales at the follow-on price. At the current price of $2.65, the stock trades at 1.0x 2025 sales, for a market cap. of $297mn, or -77%/-87% since the IPO/follow-on, accounting for shares dilution.

Unquestionably, the company went public in a favorable market environment when, in the post-COVID reopening, investors were rewarding fast-growing, digital first, innovative companies. From 2022 the context changed dramatically, with inflation fears and higher interest rates punishing precisely those, like ThredUP, which were still generating losses in pursuit of growth. Possibly the IPO timing was premature in the company operating lifecycle, but it allowed ThredUP to raise substantial funds for its expansion (to quote James Reinhart: “you go public when you can”) and add more structure and discipline to the organization. However, it was not only the market sentiment towards loss making small caps that shifted:

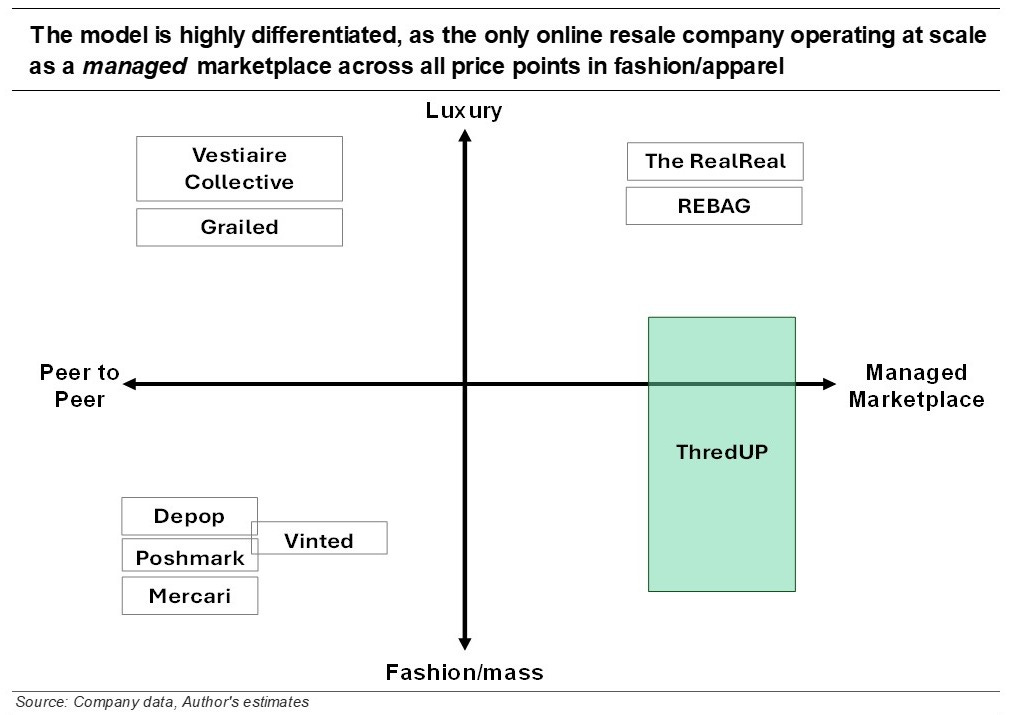

The acquisition of Remix in Europe proved misguided. Shortly after the IPO, in August 2021, ThredUP acquired a business in Europe, Remix, headquartered in Sofia, Bulgaria and selling into nine European countries. The consideration price was c.$26mn (for sales of $34mn) and supported the strategy to expand into another large emerging TAM for online secondhand clothing. Despite similarities with ThredUP’s early operations and the ambition to leverage the US know-how to drive a rapid scale-up, infrastructure build and margin expansion, the venture proved disappointing. In addition to the challenges of managing two very complex operations far apart (9 hours’ time difference between Oakland/Sofia), Remix lacked infrastructure, had yet to transition to a consignment/clean-out model (most of the inventory was owned) and, for our understanding, the execution of the retained founders’ team did not meet expectations.

ThredUP invested time and funds to drive a turnaround which, although sales roughly doubled since the acquisition, did not materialize. In December 2024 Remix was sold to its management through a buy-out (led by a new CEO appointed earlier by ThredUP) and retaining a 9% stake which leaves some optionality for the future. For context, Remix losses amounted to $37mn in 2024 ($19mn in 2023), or more than half ThredUP consolidated operating losses.

US users’ growth has stalled. While Europe was absorbing investments, the US business was shifting further to a primarily consignment model. From an accounting standpoint, this depressed reported revenue as product sales are recorded at the selling price (with a lower gross margin) while consignment revenue is net of seller payouts, discounts and returns (with higher gross margin). The transition was virtually completed in 2024, when consignment revenue accounted for 95% of total vs. 74% in 2020.

Moreover, ThredUP user growth was negatively affected by other factors: (i) it lost a portion of its more value oriented consumers which were more impacted by inflationary pressures, while the company also led an effort to increase its AOV and a more premium product mix; (ii) aggressive promotions in the post pandemic period by apparel retailers, combined the rapid growth of hyper fast fashion brands such as Shein and Temu, diminishing the price appeal of secondhand; (iii) a self-inflicted change in the on-boarding strategy for new clients in Q2/Q3 2024 (lower discount for first time buyers), which has since been reverted.

Adjusted EBITDA breakeven targets were delayed. The larger investments and heavier losses from the attempted turnaround in Europe, combined with a slower top-line growth in the US, resulted in the company having to revise earlier guidance for reaching consolidated breakeven Adj. EBITDA by 4Q2023, and on a full year basis in 2024. Neither of these targets were met for the consolidated business, although they were in fact reached for the US operations. However, given the split between US/Europe was not disclosed until Remix was sold, investors read it as a repeated guidance miss, which further exacerbated the pressure on the share price, which reached an all-time low of $0.53 in November 2024.

The operating progress in the US has been greater than what the share price suggests

ThredUP US business has improved significantly in the last four years: the challenges faced in both Europe and the US may have in fact also accelerated certain strategic developments, generating a leaner, more disciplined and efficient organization than if the operating context had been more favorable.

We also commend management for exiting Europe promptly, acknowledging mistakes made, and before it absorbed more valuable resources. The management buy-out structure leaves some optionality for a future re-entry, but the business was deconsolidated and will no longer dilute ThredUP reported results, which we believe was the correct decision for shareholders.

The company can now fully focus on the US and capitalize on its progress:

The shift to consignment mix has been completed. Consignment revenue in 2024 was 95% of total, up from 74% in 2020, which we believe marks the end of the transition, as a small portion of product revenue will continue to be sourced by certain RaaS partnerships. Hence, going forward reported revenue growth (as well as gross margin and cash flow) will no longer be impacted by the less favorable economics of owned product sales. In nominal value 2024 consignment revenue was US$246mn, up from US$138mn in 2020, or +78%, with a +16% CAGR, which we believe better represents the underlying revenue growth in the period.

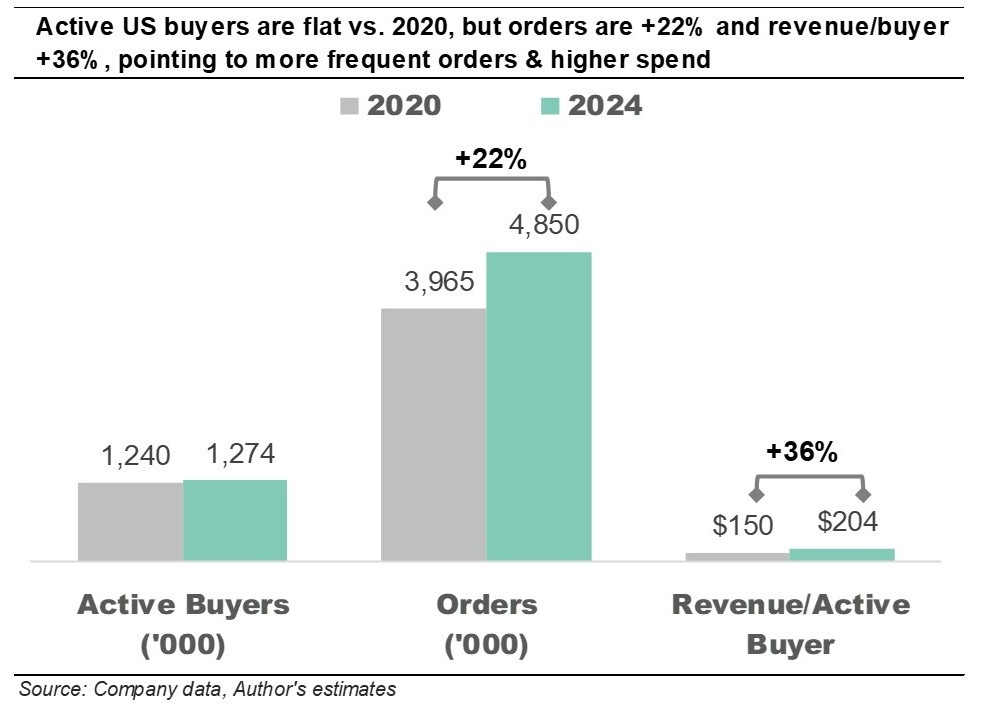

Revenue per Active Client (RPAC) and orders per client have increased. At 1.3mn in 2024, active clients have remained essentially flat vs. 2020. However, these headline numbers may mask a shift in the composition of the buyers, as we believe ThredUP lost a portion of its more value-oriented consumers, in favor of recruiting a higher income bracket customer. This is represented by the growth in RPAC in the period which is up by +36% since 2020 (from $150 to $204 in 2024). Moreover, the current client base appears to shop more often with 4.9mn orders in 2024, compared to 4mn in 2020, or a +22% increase. We estimate that the Average Order Value (AOV) has also increased to US$90, although we note that this metric can fluctuate as it tends to be correlated with buyers’ threshold for free shipping, which is now set at $89.99.

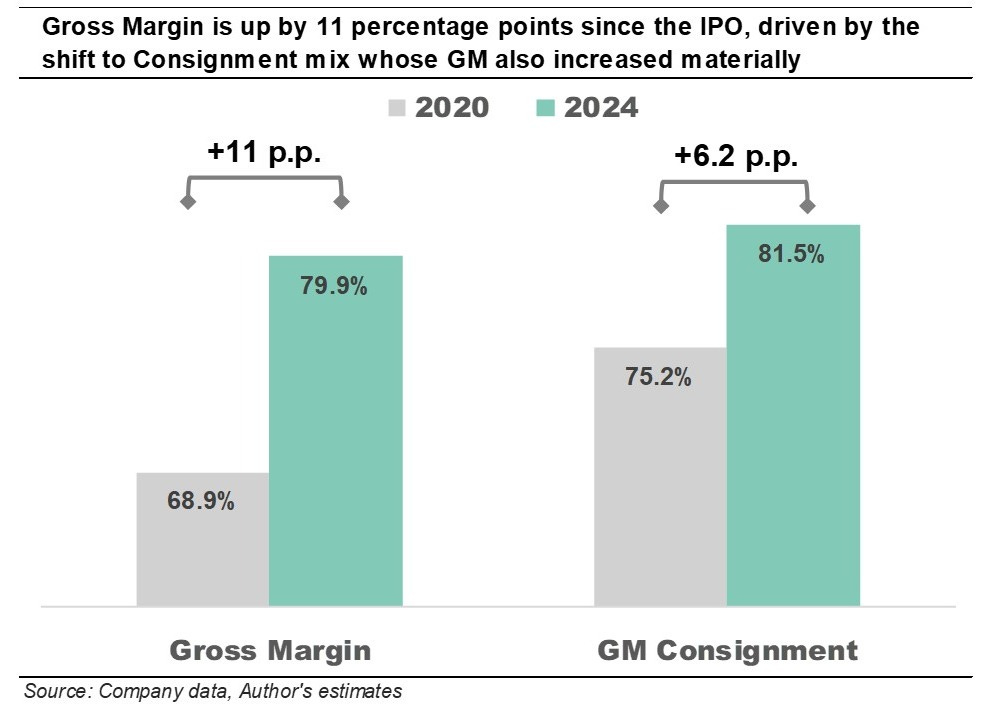

US Gross Margin and Adjusted EBITDA Margin have increased materially. The increase in consignment mix contributed to a substantial increase in the gross margin which in 2024 reached an historical high of 79.9%, from 68.9% in 2020, an increase of 11 percentage points. In nominal terms gross profit reached US$208mn from US$128mn in 2020, or a +62% increase. We note that ThredUP long-term target for gross margin was set at 75-78% and has therefore already been exceeded. Importantly, the gross margin of consignment also improved materially from 75.2% in 2020 to 81.5% in 2024, highlighting greater operating efficiencies and better mix. These improvements carried over onto the Adjusted EBITDA margin which went from -18% of revenue in 2020 to +3% in 2024.

The Contribution Margin per order is now above the targets set at the IPO. ThredUp CFO recently indicated that the contribution margin per order is now above 40%. The contribution profit is defined as the revenue minus the variable costs and gives a measure of future profitability potential, as fixed cost coverage increases at higher revenue. At the IPO it was indicated that contribution margin stood at 27%, and that the greater level for automation to be introduced with the yet-to-be-opened new DCs, had the potential to bring it to 36%. We find therefore very encouraging not only that the target was reached and surpassed, but also that it was achieved at a consolidated level, i.e. accounting for all the distribution centers. We will explore analytically in later sections how this should translate into higher consolidated profitability as revenue continues to grow.

The increase in operational efficiency is also represented by the fact that the above progress was achieved with lower headcounts, as ThredUP total employees decreased from 1,862 in 2020 to 1,630 at the end of 2024, or a 3% decline. This change included the closure of an older DC in 2022, as well as a 15% reduction in the corporate workforce.

Comparative analysis highlights superior unit economics with smaller scale and greater complexity

The singularity of ThredUP operating model and business economics can be better appreciated when comparing it to other online secondhand platforms and fashion retailers. Specifically, we have compared ThredUP metrics to The RealReal (US listed luxury-only secondhand marketplace), Vinted (the fast-growing European peer-to-peer secondhand platform, primarily for fashion), Revolve (full price fashion and luxury online retailer) and Stitch Fix (US online personal styling e-commerce).

We also looked at some of the metrics available for Depop (peer-to-peer fashion marketplace, owned by Etsy), Poshmark (also peer-to-peer marketplace, acquired by Korean e-commerce Naver in 2022 for US$1.2bn), Vestiaire Collective (the European luxury peer-to-peer marketplace) and Rebag (US luxury managed marketplace for handbags/accessories). This analysis highlights:

ThredUP has the highest Gross Margin among comps. ThredUP’s 80% gross margin in 2024 compared to The RealReal’s 75% and Revolve/Stitch Fix at 53/44%, respectively. This is explained by: (i) ThredUP full transition to a consignment model, now at 95% of total sales; The RealReal also primarily consigns (88% in 2024), but luxury requires more direct sourcing of inventory; and (ii) traditional fashion retailers offline or online (i.e. Revolve and Stitch Fix) need to buy the inventory upfront as Cost of Goods Sold. Somewhat counterintuitively, ThredUP 80% Gross Margin is achieved with much lower RPAC (c. $200 in 2024 vs. >$400 for comps) and AOV (around $90): stretching the comparison it could be stated that ThredUP has a higher Gross Margin than Hermès (70% in 2024) by selling fashion at lower price than GAP, H&M or Zara.

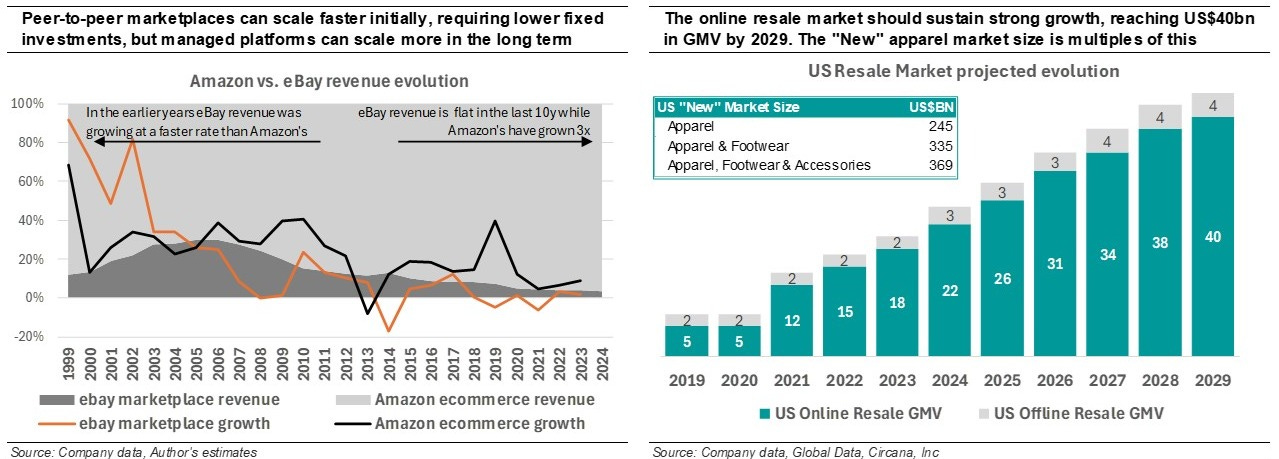

ThredUP has by far the highest Take Rate in secondhand. While peer-to-peer platforms can scale revenue and users faster as they require relatively limited fixed investments acting merely as middle-men, the downside of this model is a substantially lower Take Rate, ranging from 6% to 20% in fashion resale (notably for bigger and broader merchandising platforms such as eBay and Etsy, the Take Rate is also lower at 14%/22%, respectively). For luxury managed marketplaces such as The RealReal (39% in 2024) or Rebag (25% estimated), the Take Rate is higher than peer-to-peer platforms, but sellers of luxury items expect higher pay-outs, the higher the selling price. ThredUP Take Rate of c. 70% per order is unique in the industry and is achieved thanks to the lower or no pay-out for the large volume of lower priced items they consign.

ThredUP reached Adj. EBITDA profitability with much lower revenue. ThredUP 2024 Adj. EBITDA margin of 3% was achieved with a significantly lower revenue base than when other resale platforms reached Adj. EBITDA breakeven. When Vinted had a similar level of revenue in 2021, its Adj. EBITDA margin was -48% and was still -13% in 2022 with revenue of EUR370mn (Vinted only reached positive Adj. EBIDA margin of 13% in 2023, with sales of EUR596mn). Given the similarity in the operating model, the comparison with The RealReal is even more telling: The RealReal also reached positive Adj. EBITDA margin for the first time in 2024 of 1.6%, but it did it with US$600mn in revenue, or more than double ThredUP level. In 2020, when The RealReal revenue was US$298mn, its Adj. EBITDA margin was -12%.

ThredUP processes more orders per active client. Key to ThredUP business model is the capability to process efficiently the vast volume of supply it receives, and to sell it profitably fast, to maximize turns and return on capital. In the IPO prospectus management disclosed that 43% of the items listed sold within 30 days, and 69% within 90 days. We believe these sell-through rates have increased since, as suggested by total orders/active clients at 3.8x in 2024, from 3.2x in 2020. This also compares favorably with comps, being higher not only than The RealReal but also Revolve and Stitch Fix. We note that this metric could screen even more favorably if adjusted for return rates, which we believe are considerably lower for ThredUP, compared for instance to Revolve, where they are greater than 50%. Since 2023 ThredUP introduced several initiatives to reduce return rates, such as “keep for credit” and “thrift promise”, to incentivize buyers to reduce returns and save on shipping and processing. Moreover, recent visual technology innovation in measurements and defect detection are expected to continue reducing return rates going forward.

2025 should mark the beginning of a return to solid top-line growth

With the European venture behind and the US business now profitable, we expect 2025 to mark the beginning of reaccelerating revenue growth. 4Q2024 results already showed improvements, coming above guidance (+9% yoy in sales, 7.4% Adj. EBITDA margin and sequential growth in active buyers and orders). For FY2025 management guided for revenue at +6% yoy (midpoint) and flat Adj. EBITDA margin vs. 2024. We deem these targets as conservative, reflecting the ambition to “beat-and-raise” after recent disappointments, and we see upside from:

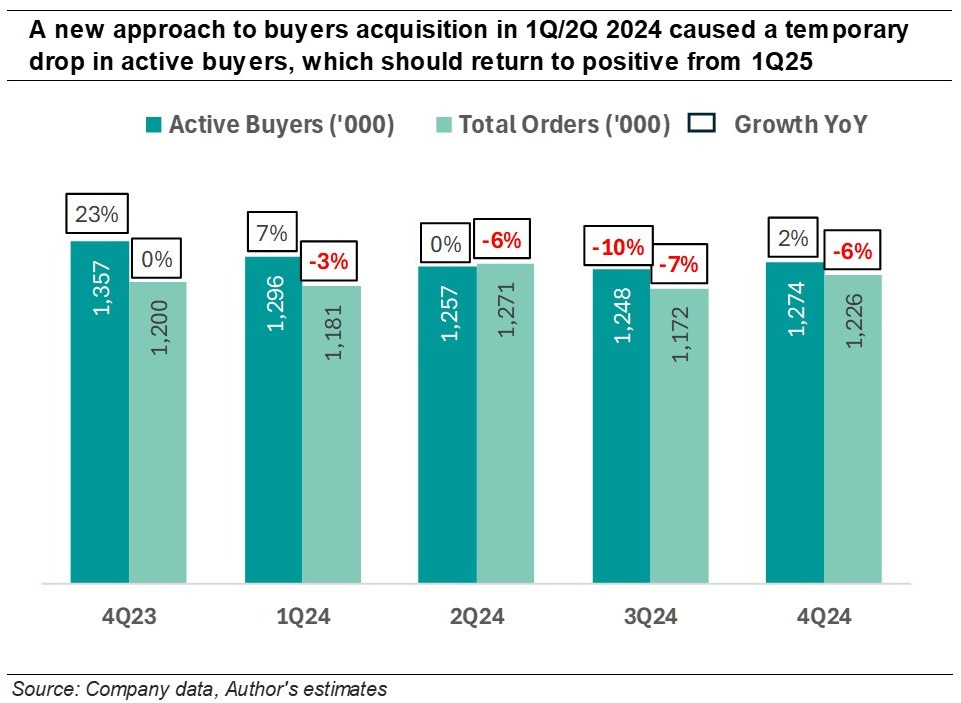

We expect positive Active Buyer growth to return and accelerate throughout the year. Active buyers are defined as those who made at least one purchase in the previous 12 months, and this is therefore a rolling measure. Starting in March 2024 and for the following 3 months, ThredUP tested a new on-boarding strategy for recruiting new customers, essentially reducing the discount for first-time buyers, which did not perform as hoped and resulted in the loss of c.90,000 new buyers (7.5% of 2024 total active buyers), which will carry through until annualized. The promotional structure was reversed in June, resuming historical trends.

Management stated that Q3 new buyers acquisition was the strongest for the previous two years, and that it was up +32% yoy in Q4. We expect this will result in a return to positive active buyers growth starting in Q1, and accelerating throughout the year, over lower comps from last year’s declines and benefiting from higher investments in customers acquisition.

AI innovation in front and back-end to bear more visible benefits. Starting in 2Q2024 ThredUP introduced a series of AI driven innovations, first in beta and then rolled out broadly from 3Q, aimed at improving customer experience and at driving efficiencies. These were: (i) image search, whereby clients can upload pictures of desired styles to generate alike available for purchase items, or shop similar for any product on the site; (ii) language search, whereby clients can search for items based on free-text descriptions rather than filters (i.e. “date night” vs. filtering for “red/dress”); (iii) style chat, which lets clients describe a style and returns a corresponding look with an AI generated “real-life” model. Moreover, the company introduced other innovations, including label pictures for all items, filtering by material (such as “natural fiber”), 360-degree pictures for most items, and electronic measurements.

These new AI/digital tools can benefit discovery disproportionally in resale, reducing the “paradox of choice”, as customers can be overwhelmed by the vast assortment. Moreover, better photography, descriptions and measurements improve sell-through, increase accuracy and reduce returns with a material impact on profitability per item and turns.

Re-acceleration of investments in marketing and customer acquisition. ThredUP spent less than US$50mn in marketing in 2024, or 18% of sales, a level which, like the gross margin, is already meeting its long-term target of 15-18%. As revenue grows and fixed cost coverage increases, we see room for a strategic increase in marketing spend (Revolve and Stitch Fix spent US$170mn and US$120mn in 2024). ThredUP management commented that since AI search technology was introduced, repeat rates and lifetime value to customer acquisition costs have been trending to all-time highs which would justify higher investments. We also note that ThredUP marketing dollars appear to be very productive, averaging at around $10/order which compares to $16/$19/$49 for The RealReal, Revolve and Stitch Fix, respectively.

More favorable market and competitive environment. The US consumer remains pressured by inflation, high interest rates and broader uncertainty: this was also true in 2022/23, but at the time ThredUP assortment was more geared towards bargain-hunter, lower income consumers who, in large part, stopped purchasing entirely. In 2025 ThredUP assortment has been sculpted towards higher quality items and may benefit from higher income consumers moving down the value scale. Moreover, the likely introduction of tariffs on imported apparel may make “new” more expensive, increasing the appeal of secondhand, together with the removal of the “De Minimis” exception, which has been instrumental for supporting the phenomenal growth of Shein and Temu in the last few years.

We expect strong FCF generation and Adj. EBITDA margin as revenue scales

We expect ThredUP revenue to continue scaling strongly over the medium term and to potentially exceed US$1bn within the next 10 years. As the business grows, crossing the threshold of positive FCF in 2025, ThredUP attractive economics flywheel can shine:

We project double-digit Adj. EBITDA margin with $100mn incremental revenue, and >20% once they cross $500mn mark. In our estimates we have assumed that the company can retain the recently disclosed contribution margin of 40%: while automation in progressing and AI advancements may yield further efficiencies at greater scale, we expect these will ultimately be re-invested in demand creation. Our model shows that as fixed costs (c.US$100mn annually) coverage increases, ThredUP Adjusted EBITDA margin will cross into double-digits with incremental US$100mn in revenue, which we expect can be reached by 2027. Once the US$500mn level is surpassed, we expect an Adj. EBITDA margin of >20% and higher thereafter, to meet or exceed the company’s long-term target of 20-25%.

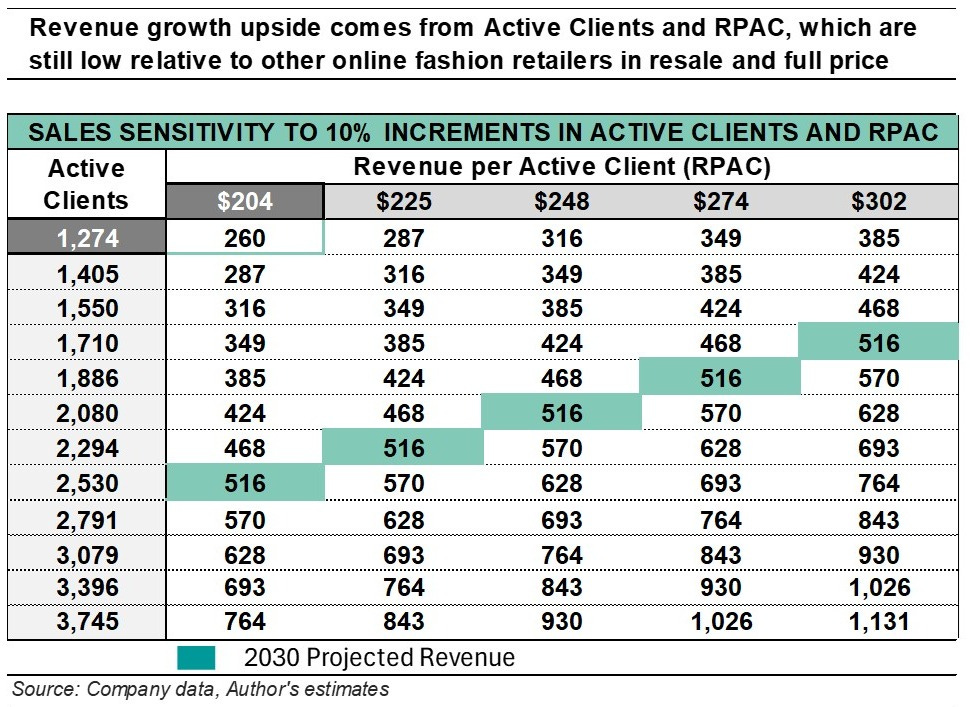

The company has multiple levers to drive revenue growth. Our assumptions call for revenue 2024-29 CAGR of 12%, crossing into the US$500mn mark by 2030. In our model we have kept Order/Client stable at 3.8x which is already among the highest in online retail: we however see material upside in growing Active Clients count as resale awareness and adoption increases (as discussed earlier ThredUP 1.3mn Active Clients are less than half those of Stitch Fix and Revolve) as well as in RPAC, the lowest among peers, from both higher AOV and average item price, as the company recruits higher income consumers and continues sculpting its supply towards higher quality brands and in-season/in-demand merchandising.

We present a sensitivity in the following tabe for how our 2030 projected revenue of US$516mn can be achieved at different levels of number of Active Clients and Revenue per Active Client.

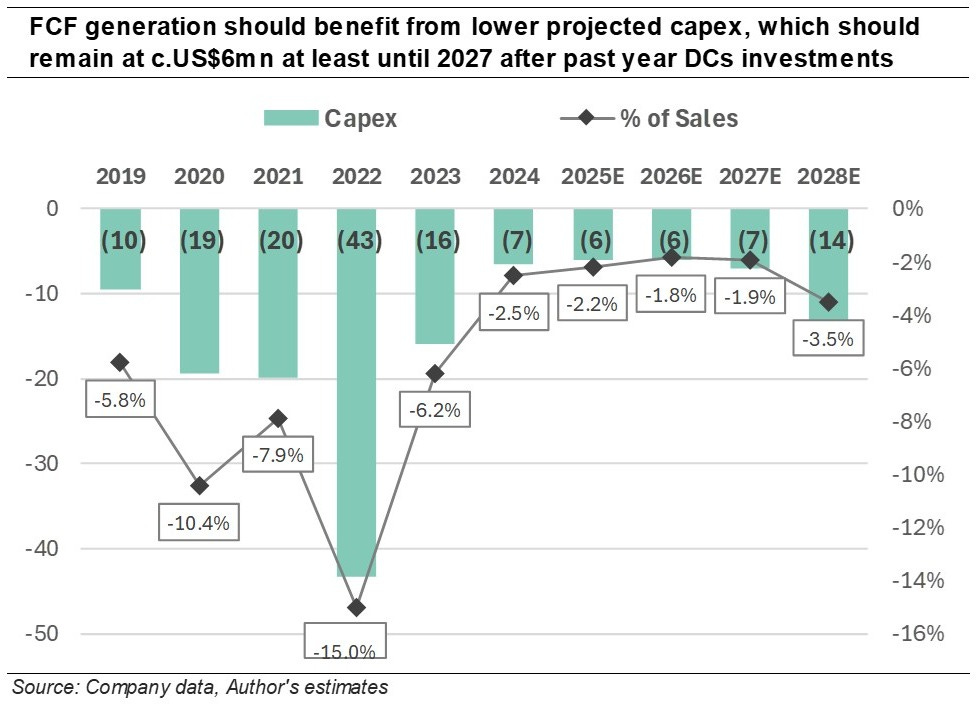

FCF should ramp-up fast with reduced capex needs as ThredUP grows into its existing capacity. As Adj. EBITDA turns firmly positive, we expect FCF conversion to be very strong, given the very limited working capital needs in ThredUP’s consignment model (negative WC cycle) and expected moderate capex needs. Management has guided for capex to remain at around US$6mn per year until at least 2027. This follows a bigger push in the founding years, and more recently for the completion of the more advanced DC in Dallas, TX which currently operates at 25% capacity and whose storage can grow by a further 150%. This would suggest that current capacity can sustain at least a doubling of the business and that thereafter capex investments will be relatively lower, as DCs have been designed for modular expansion, and self-financed from cash flow.

We expect positive GAAP EPS from 2027. We are projecting ThredUP to reach quarterly positive GAAP EPS in 2026 and on an annual basis in 2027. This will be primarily driven by the growth in Adj. EBITDA, as well as lower projected stock compensation expenses, as guided by management starting in 2025, and lower interest costs from debt repayment. By 2030 we expect GAAP EPS to reach US$0.50/share, assuming some share-count reduction from buybacks financed by the strong FCF generation.

In summary, for 2024-29 we project ThredUP to deliver: Revenue CAGR of 12%; Adjusted EBITDA CAGR of 58%; GAAP Net Income to move from a -US$40mn loss in 2024 to a US$42mn profit in 2029. Our projected 2029 FCF is US$83mn or $0.68/share.

Projected Financials and Valuation

In the following exhibit we present summary tables with projected financials, valuation multiples and yields at current share price of $2.65/ share and at a price objective of US$25.0/share by 2030. These estimates are underpinned by the following considerations and assumptions:

We project Revenue 2024-30E CAGR of 12%, which we view as conservative. ThredUP and GlobalData most recent Resale Report projects the resale industry gross merchandise value in the US to grow with a CAGR of 13% through 2029, reaching US$40bn. As a leader in this sector, we assume that ThredUP can grow its revenue at least in line with the industry, but we set our projections somewhat below these estimates to account for uncertainty in the forecast given the industry is still in its infancy. Our estimates also acknowledge that ThredUP growth should be solid, but paced: the company needs to balance both demand and supply to drive the flywheel, and excessive spurs in either can create operational challenges. A case in point was 2021 when, during the COVID lockdowns, the company was suddenly flooded with supply, causing bottlenecks and delays in processing (ThredUP had to stop accepting bags for several months due to excessive backlog).

We are assuming stable Gross Margin relative to 2024, and to remain at 79-80% level following recent years’ progress which we believe are now consolidated. We don’t expect additional leverage or expansion going forward as we believe the company will share any incremental upside with its customers to sustain active buyers growth and recruit new clients through strategic promotions and discounts.

Our Adjusted EBITDA margin progress is driven by greater fixed cost coverage. We assume that the level of contribution margin of 40%, as indicated by management, can be maintained but will not increase further. Rather, we expect the company to possibly increase marketing investments to fuel top-line growth.

The Balance Sheet should strengthen from strong Free Cash Flow generation starting in 2026. We expect the company to reach FCF breakeven in 2025, with stronger conversion from 2026: we are not assuming significant additional Capex in the forecasted period as the projected approximate doubling in revenue can be supported by growing into current DCs capacity. Any additional investments can however be self-financed, given ThredUP has currently a net cash position, which should ramp quickly once FCF turns positive. We don’t forecast use of funds for either dividends or acquisitions, but we assume some limited buybacks reflected in a moderate reduction in share counts from 2028 to offset dilution from RSUs.

Valuation: At the current price of US$2.65 the stock trades at 1.0x 2025 expected revenue and on EV/Adj. EBITDA and Price/Earnings of 0.6x and 5.5x relative to 2030 estimates, the end of the forecasted period, with a 2029 FCF yield of 33%.

We set a Price Objective of US$25.0/share by 2030: at this price the 1 year forward 2030 Price/Revenue would be 5.1x, EV/Adj. EBITDA 19.0x and P/E 38x, with an implied FCF yield of 4.5%. If the projected estimates are reached, we deem this valuation achievable, reflecting the strong potential growth and FCF profile. Based on our estimates, by 2030 Return on Equity and Return on Capital Employed would reach 33% and 25%, respectively.

We also note that at the end of the forecasted period, ThredUP would have surpassed US$500mn in revenue with >20% EBITDA margin: for context, in Europe, resale platform Vinted was valued at EUR5bn (US$5.5bn) in its most recent funding round (as per company disclosure) with latest published revenue (2023) of EUR596mn, Adjusted EBITDA of EUR76.6 (13% margin) and Net Income of EUR17.8 (3% net margin). At the projected potential price of US$25.0 by 2030, ThredUP implied market cap would be US$3bn, still materially below Vinted most recent valuation.

Risks to growth and margins expectations: Given the complexity of ThredUP operating model, the execution risk is intrinsically high. The company has a clear vision and targets but to achieve them, it needs to balance supply, demand and a very sophisticated infrastructure. For the topline, the capability to continue attracting more sellers, quality items and more buyers are the main risks, in our view. For margins and cash flow, volatility and downside risk may come from higher investments to acquire new buyers as well as higher capex investments to expand capacity sooner than anticipated.

Further upside may come from RaaS, Direct Selling, Social Commerce and US M&A

Projected revenue growth assumes the current product mix to remain relatively stable, and a gradual increase in Active Clients. We identify below additional factors that could present incremental upside to revenue in the next few years:

Strengthening RaaS partnerships. ThredUP currently partners with over 50 brands and retailers (including Gap, J. Crew, Madewell, Athleta, The Container Store), which leverage its operating platform through 3 main services: co-branded clean outs, credit through the marketplace cashout, and a turn-key resale shop using ThredUP existing inventory. In this segment ThredUP competes with other companies/models (such as Trove and Archive) that enable brands to process resale directly: this approach is however more complex and requires greater investments to operate at scale. For ThredUP Raas is a great tool to generate quality supply, high margin fees from the brands, and add virtually for free additional storefronts.

After a big ramp in 2022/23, incremental RaaS partnerships have slowed and we expect this model to evolve further: (i) the new AI/search technology on the core marketplace is yet to be introduced in the partners’ storefronts and may drive faster adoption and greater sales; (ii) ThredUP could offer, for a fee, additional services, including valuable data intelligence it collects on brands through the marketplace.

In-roads in Direct Selling and Social Commerce. In August 2024 ThredUP teased a “Direct Selling” option for sellers, through a sign-up link on the website. CEO James Reinhart later played this down, stating that it was only done to assess interest, and that nothing should be expected in the short term. We note however that the link is still active, and we see merit in the idea: ThredUP has positioned itself as “one-stop” solution, yet some sellers may remain resistant to ship certain items, either due to their monetary, emotional value or else. Direct Selling could be an “add-on” to the clean-out: once a kit is accepted the seller could opt to list, for an incremental fee, a limited number of items directly. This would align incentives, maintain or increase the flow of supply, and expand assortment and engagement.

In addition, in November 2024 a new hire for the freshly created position of Head of Social Commerce was appointed. We expect ThredUP to make a strong push into this channel, which could prove a powerful tool to drive incremental sales and to recruit new, younger, customers: according to the 2025 Resale Report, 39% of younger shoppers surveyed made a secondhand apparel purchase on a social commerce platform in the previous 12 months. These trends are supportive of ThredUP having a dedicated strategy for social commerce, leveraging its integrated digital capabilities and unparalleled library of items to generate content.

Gradual shift to more premium assortment and luxury. One of ThredUP’s core competitive advantages is its capability to process and generate value from vast volumes of mass fashion: the company could however sculpt its merchandising towards a more aspirational positioning. A step in this direction was the full roll-out of Premium clean out kits in the second half of 2024: in the 4Q24 earnings call management indicated that items from these kits already account for 10% of new listings, and that they are priced at c.50% higher than those sourced from standard bags. Greater contribution from premium kits could drive revenue from their higher fee ($34.99 vs. $14.99 for standard), and from the positive impact on the price mix.

ThredUP has also partnered with luxury resellers like Rebag and Luxclusif to host, for a fee, their merchandise on the site (partners take care of fulfillment) which is contributing to the perception, for both buyers and sellers, that ThredUP is not only a destination for cheaper fashion.

US M&A could be explored in the medium term. After the painful experience in Europe, we think the company will focus on organic growth in the US and on strengthening its balance sheet. Once solid FCF generation kicks in, acquisitions in the domestic market may however be explored. Potentially these could target: (i) emerging resale technology companies, some of which are already showing promising innovation, to reinforce both RaaS and marketplace advantages; (ii) other resale platforms to either enhance a potential Direct Selling offering, or target different segments of the market. In particular, the company may see strategic merit in establishing a separate storefront for more luxury and premium items.

A Mission driven company with long-term Vision and Sustainability & Innovation at its core

We conclude this analysis with some additional broader considerations and comments which we believe are less tangible and quantifiable, but are important in the full understanding of ThredUP:

The ambition to be a “Generational Company”: ThredUP stated mission is to “inspire a new generation of consumers to think secondhand first”. CEO James Reinhart elaborated on this in several public interviews explaining that he envisions a future when consumers will recycle unused clothing by default behavior, the same way today consumers recycle plastic. To achieve this goal the company is doing its part operationally, but is also advocating with the broader universe of stakeholders, raising awareness, including with Government, though initiatives such as supporting The Americas Trade and Investment Act (“The Americas Act”), a bi-partisan bill introduced in 2024 which incorporates $14bn in federal incentives to catalyze domestic circularity in apparel, or lobbying for the removal of sales taxes on secondhand.

Long-term mindset. This generational view of the business mission is expressed in a very long-term approach to strategy, capital allocation and shareholder value creation. Management often refers to the example of other innovative companies which essentially created new industries over decades, not years, such as Netflix or in retail, off-price champions like T.J. Maxx. Notably in May 2023, ThredUP announced the dual-listing of its A-shares on the Long-Term Stock Exchange (LTSE), adhering to its principles-based listing standards requiring disclosures into how a company builds its business for the long term.

“Do Hard Things”. This is another ethos often cited by ThredUP CEO, which instructed the development of the company since its founding. ThredUP has essentially built a previously non-existing infrastructure for single SKUs reverse logistics through hard investments in processing and technology, with the view that they will compound over time. We don’t think that any other company is competing directly with ThredUP at a similar level of complexity and scale, and we view it unlikely anyone ever will, given the different funding environment today compared to when ThredUP started building. The company is therefore largely in a race against itself and, should it succeed, we expect its competitive advantages to keep compounding and expand over the coming years, also amplified by the fast progress in Artificial Intelligence, Data Processing and Robotics.

Innovation and technology. Management commented that ThredUP can be defined as a technology and logistics company which happens to sell fashion. The company hires more software engineers than stylists, possibly to a fault as merchandising and brand aspiration are equally relevant in attracting buyers, but its technology DNA has contributed to the fast adoption of innovation, including the recent roll-out of AI tools, which are adding to the company’s competitive advantages. Innovation appears to be embraced broadly in the organization: other examples include the adoption of 4-days work week for corporate employees and a culture of “metered funding” in capital allocation and product development.

Sustainability at its core. The debate among investors around the merit of ESG (Environment, Social and Governance) metrics is evolving. Nonetheless, we note that ThredUP mere existence makes it a sustainability champion. In its last published Impact Report, the company indicated that since its founding it has processed more than 200mn secondhand items, saving 791mn lbs of CO2 emissions, and 8.4bn gallons of water. These metrics are impressive and are important for the environmental impact broadly, but they are also a powerful tool for the company to attract and retain talent, as sustainability is an increasingly important variable for choosing where to work (and where to shop).

Founders led. The two co-founders of the company, James Reinhart and Chris Homer, remain the CEO and COO of ThredUP and control the decision making through their B-shares, which has allowed them to retain focus and commitment to the very long-term objectives of the business.

Disclaimers:

I, Luca Cipiccia, hereby certify that this report is for informational purposes only and reflects my personal opinions as a private investor. It is not intended as financial, legal, or investment advice, nor is it an offer to buy or sell securities. All information is based on publicly available data as of March 27, 2025, and I make no guarantees about its accuracy or completeness. Investing involves risks, including the potential loss of principal, and past performance is not indicative of future results. Readers should conduct their own research and consult a qualified professional before making investment decisions. I am an investor in ThredUP, but this does not imply endorsement by the company. Use this information at your own risk.